Thus, the valuation equation:

A Citizens' IndyCar Republic: Fell the House of France!

Those who have read this blog in the past know that I have no tolerance for those who blame Versus for IndyCar's cable television ratings woes.

Those who have read this blog in the past know that I have no tolerance for those who blame Versus for IndyCar's cable television ratings woes.

The numbers provide still more reason to undertake the New Day Rising project. The IndyCar Championship race barely topped a start-up league.

We now turn our attention back to completing our New Vision for the sport.

Roggespierre

Notice that the decrease began at approximately mid-season in 2008. The 2009 Long Beach race, the second event that was telecast on Versus, outperformed four races in 2008 that were telecast on either ESPN or ESPN2. In addition, this year's race at Texas was competitive with the later 2008 events that were telecast on cable.

Notice that the decrease began at approximately mid-season in 2008. The 2009 Long Beach race, the second event that was telecast on Versus, outperformed four races in 2008 that were telecast on either ESPN or ESPN2. In addition, this year's race at Texas was competitive with the later 2008 events that were telecast on cable.

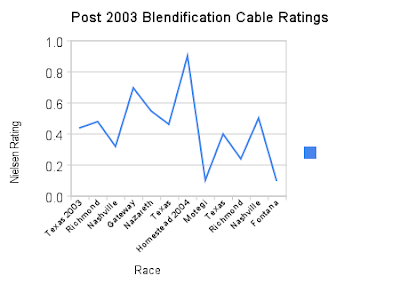

Notice the similarity to 2008 and 2009. With the lone exception of the 2004 opener at Homestead, the general trend is downward. I would argue that 2003 and 2004 were very similar to the past two years.

Notice the similarity to 2008 and 2009. With the lone exception of the 2004 opener at Homestead, the general trend is downward. I would argue that 2003 and 2004 were very similar to the past two years.

We have examined the IRL IndyCar television ratings history for both the Indianapolis 500 and other races that aired on broadcast networks. Now, finally, we look at cable television ratings.

The histogram below contains comparative Nielsen cable ratings for IRL IndyCar events from 1996 through 2009. Specific races that were telecast on cable television in each year are identified below the graph.

Note that individual event ratings were not available for 1999, 2000, and 2002. The season average is presented for each race in those years.

Conclusions, anyone?

Roggespierre

People will tune in for college football, bull riding, cage fighting and cycling, but not for IndyCar. It needs to be on either a network or ESPN. IndyCar needs the casual fan, the channel surfer. -ApologistsThese excuses are not justification. They are condemnation.

television viewers have spoken clearly. The guy on the bike makes a difference.

television viewers have spoken clearly. The guy on the bike makes a difference.We like Miller because he loves the Indianapolis 500 and IndyCar racing. We do, however, disagree with him at times. His views tend to mirror those of insiders, which is understandable. But insiders don't get to determine what the market will accept."...IndyCar needs to get out of the Versus deal. It doesn't matter if the show is good, nobody's watching." - Robin Miller

The ongoing DirecTV saga notwithstanding, Versus has demonstrated that it is perfectly capable of drawing a legitimate audience if it has a product that U.S. television viewers want to see. The problem is not Versus; it is that the present permutation of IndyCar racing is not designed to attract a U.S. audience.

This series has no legacy stars to lean on - no A.J. Foyt, Mario Andretti, Al and Bobby Unser, Gordon Johncock, and so on. It therefore should race at venues that will attract drivers that can be sold to American fans of motorsports. Instead, the IndyCar Series is moving in the opposite direction.

There is nothing wrong with road and street racing, per se. The problem is that, combined with formula cars and international events, road and street races have unintended consequences. They tend to attract international road racers for whom there is very limited demand in the U.S. market.

How, exectly, are events in Toronto, Edmonton, Japan and Brazil supposed to increase U.S. television ratings? A good portion of street racing's appeal is that it can draw attendees for reasons that are unrelated to the core racing product. Why, then, should the IRL be surprised when it fails to convert those event-goers into television viewers? There are other parties to attend, after all.

Versus has a right to be more frustrated with IndyCar than IndyCar is with Versus. Remembering who is the customer and who is the supplier is a frequent challenge for IndyCar insiders, so we shall remind them here that in this case the customer is Versus. It paid money for this - not much, but some.

Versus has promoted the IndyCar product during popular programming, only to discover that there is very little demand. Production quality has generally exceeded expectations. On-air talent, another frequent object of blame, has improved.

IndyCar is a market failure because the product is designed to please participants and insiders rather than auto racing consumers in the United States. The latter group has demonstrated that it will tune in consistently to watch a product that is designed for its benefit.

It's not 1995 Anymore

Television ratings are less important when market inefficiencies can be exploited and supply chains can be arbitraged. However, unlike CART, the IRL will not succeed in these pursuits because tobacco advertising inefficiencies have been corrected and nearly all U.S. industrial supply chains lead to NASCAR (sans-culottes!). That is why IndyCar is now attempting to arbitrage the Brazilian supply chain.

As we have written before, we like television ratings because they provide a reliable measurement of market acceptance. They can not be bought. They are not influenced by comp tickets and compulsory attendance at corporate outings. They can not be camouflaged by signage and majestic terrain. They are not perverted by four-day attendance figures. They tell the truth even when the truth hurts badly.

The IRL must manage its product. Doing so will require that it take actions that will not be liked by some of its suppliers of racing teams. Costs must be slashed. Many drivers must be replaced.

Unless and until customers are served to their satisfaction, the IndyCar Series will remain a market failure. To think that ABC and ESPN would accept a time buy is ridiculous. ESPN could not wait to get rid of this product. That is why it allowed the IRL to leave a year early.

The marketplace is competitive. ESPN has many, many more options than it did back when CART bought air time. IndyCar racing in its present form does not deserve a major U.S. television partner.

Versus is stuck with IndyCar.

Roggespierre

That isn't much of a national audience. However, it's no secret that Versus is a fledgling sports network. Perhaps we should compare the IndyCar numbers to those of other sports properties on Versus.

IndyCar is competitive with other prime time programming on Versus. Unfortunately, this is due to the audience that tuned in for the race at Texas Motor Speedway. Both Richmond and Kentucky failed to match the network average in prime time. Texas more than made up the difference. IndyCar races at TMS have been very good since the track opened. It is apparent that the series has earned some brand equity at TMS.

Texas easily beat the NHL average, which was also topped by Long Beach. Again, TMS and the Toyota Grand Prix are established events that have achieved some brand recognition. Indy 500 Pole Day (385,000 viewers) and Bump Day (349,000) also beat the average NHL game. This is impressive; the NHL should have an advantage because most of its games are in prime time. Less impressive is the fact that Kansas and Kentucky combined to draw fewer viewers than Indy Pole Day.

These numbers lend significant insight. Let's hope that IRL management is paying attention. As a function of television viewership, the Tour de France with Lance Armstrong among the leaders is worth almost 98% more than the same event without Lance Armstrong

The bicycles and the race stages were largely unchanged. Most competitors and teams were similar year-to-year. It was Armstrong's comeback that increased the Tour de France product's competitiveness in the U.S. television market by 98%.

This is why the IRL must actively manage its product. In most firms, this is considered a core management activity. Unfortunately, it seems that the IRL is more interested in serving its suppliers of racing teams than serving its U.S. TV distribution customer.

Now that it knows what one American star can do for ratings, Versus should press IRL management to provide competitors that might do the same for IndyCar racing. Currently, management is moving in the opposite direction. New cars that are too costly will necessitate more drivers who are also financiers. Additional road and street races will attract more competitors that can't be sold to a U.S. television audience.

We're guessing that Versus will soon become the latest excuse for IndyCar racing's failure to perform in the marketplace. The league and its teams will talk about limited reach and explain that they need time to make the partnership work. The latter might be true, but there is little hope for the long term or any term if the product is not changed in any substantive way.

Do not believe for a moment that Versus is not capable of drawing a credible audience right now if it has a product that U.S. television viewers actually want to see.

The 2008 Oregon v. Oregon State football game on Versus averaged 1.6 million viewers

DirecTV contract negotiations notwithstanding, Versus has increased its reach since the 2008 Civil War football game. The IRL would have to increase its average audience 586% in order to match a rating that Versus has already achieved.

Therefore, we shall restate the obvious. If IndyCar fails to increase ratings on Versus, then it will be the fault of IRL management and its suppliers of IndyCar racing teams.

Roggespierre

Strategic Initiatives that IRL Management Will Not Do

Non-Strategic Activities that IRL Management Will Do

Versus must regret wasting valuable air time promoting this undisciplined dog. The value of its broadcast asset is decreased by each IRL management action above. How so? The reasons vary by venue.

If IRL management continues to follow its non-strategic course, then the Committee of Public Safetly suspects that Versus is probably looking forward to two distinctive landmark occasions.

We are unable to identify a 2009 IRL management decision that can be synthesized with the interests of the league's initially enthusiastic U.S. television partner. No, lining up advertising purchases by Apex Brasil and IZOD does not count. We'll explain when we further examine this issue after ratings for Sonoma are released next week.

Recall that the exquisitely capitalized CART series effectively purchased and re-sold television time for the duration of its existence. That oganization inherited stars like Foyt, Andretti, and the Unsers and developed some of its own, such as Mears, Sullivan and Rahal.

The present iteration of IndyCar racing has no stars of their caliber. More troubling, IRL management activities suggest that establishing new stars that would better serve the interests of the U.S. television partner is not a priority.

Roggespierre