Thus, the valuation equation:

A Citizens' IndyCar Republic: Fell the House of France!

Those who have read this blog in the past know that I have no tolerance for those who blame Versus for IndyCar's cable television ratings woes.

Those who have read this blog in the past know that I have no tolerance for those who blame Versus for IndyCar's cable television ratings woes.

Notice that those nascent urban racing markets that IndyCar appears to be pursuing are not at the top of the list.

Roggespierre

The numbers provide still more reason to undertake the New Day Rising project. The IndyCar Championship race barely topped a start-up league.

We now turn our attention back to completing our New Vision for the sport.

Roggespierre

Notice that the decrease began at approximately mid-season in 2008. The 2009 Long Beach race, the second event that was telecast on Versus, outperformed four races in 2008 that were telecast on either ESPN or ESPN2. In addition, this year's race at Texas was competitive with the later 2008 events that were telecast on cable.

Notice that the decrease began at approximately mid-season in 2008. The 2009 Long Beach race, the second event that was telecast on Versus, outperformed four races in 2008 that were telecast on either ESPN or ESPN2. In addition, this year's race at Texas was competitive with the later 2008 events that were telecast on cable.

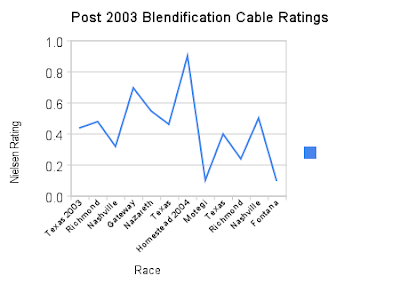

Notice the similarity to 2008 and 2009. With the lone exception of the 2004 opener at Homestead, the general trend is downward. I would argue that 2003 and 2004 were very similar to the past two years.

Notice the similarity to 2008 and 2009. With the lone exception of the 2004 opener at Homestead, the general trend is downward. I would argue that 2003 and 2004 were very similar to the past two years.

We have examined the IRL IndyCar television ratings history for both the Indianapolis 500 and other races that aired on broadcast networks. Now, finally, we look at cable television ratings.

The histogram below contains comparative Nielsen cable ratings for IRL IndyCar events from 1996 through 2009. Specific races that were telecast on cable television in each year are identified below the graph.

Note that individual event ratings were not available for 1999, 2000, and 2002. The season average is presented for each race in those years.

Conclusions, anyone?

Roggespierre

Roggespierre

Roggespierre

It is also interesting that the DirecTV exodus from Versus did not seem to affect IndyCar. Chicagoland and Sonoma were run prior to the DirecTV blackout. Motegi came after the blackout. Its location and start time seem sufficient to explain the slight drop from the previous two races. The DirecTV impact would appear to be minimal.

It is also interesting that the DirecTV exodus from Versus did not seem to affect IndyCar. Chicagoland and Sonoma were run prior to the DirecTV blackout. Motegi came after the blackout. Its location and start time seem sufficient to explain the slight drop from the previous two races. The DirecTV impact would appear to be minimal.

People will tune in for college football, bull riding, cage fighting and cycling, but not for IndyCar. It needs to be on either a network or ESPN. IndyCar needs the casual fan, the channel surfer. -ApologistsThese excuses are not justification. They are condemnation.

television viewers have spoken clearly. The guy on the bike makes a difference.

television viewers have spoken clearly. The guy on the bike makes a difference.We like Miller because he loves the Indianapolis 500 and IndyCar racing. We do, however, disagree with him at times. His views tend to mirror those of insiders, which is understandable. But insiders don't get to determine what the market will accept."...IndyCar needs to get out of the Versus deal. It doesn't matter if the show is good, nobody's watching." - Robin Miller

The ongoing DirecTV saga notwithstanding, Versus has demonstrated that it is perfectly capable of drawing a legitimate audience if it has a product that U.S. television viewers want to see. The problem is not Versus; it is that the present permutation of IndyCar racing is not designed to attract a U.S. audience.

This series has no legacy stars to lean on - no A.J. Foyt, Mario Andretti, Al and Bobby Unser, Gordon Johncock, and so on. It therefore should race at venues that will attract drivers that can be sold to American fans of motorsports. Instead, the IndyCar Series is moving in the opposite direction.

There is nothing wrong with road and street racing, per se. The problem is that, combined with formula cars and international events, road and street races have unintended consequences. They tend to attract international road racers for whom there is very limited demand in the U.S. market.

How, exectly, are events in Toronto, Edmonton, Japan and Brazil supposed to increase U.S. television ratings? A good portion of street racing's appeal is that it can draw attendees for reasons that are unrelated to the core racing product. Why, then, should the IRL be surprised when it fails to convert those event-goers into television viewers? There are other parties to attend, after all.

Versus has a right to be more frustrated with IndyCar than IndyCar is with Versus. Remembering who is the customer and who is the supplier is a frequent challenge for IndyCar insiders, so we shall remind them here that in this case the customer is Versus. It paid money for this - not much, but some.

Versus has promoted the IndyCar product during popular programming, only to discover that there is very little demand. Production quality has generally exceeded expectations. On-air talent, another frequent object of blame, has improved.

IndyCar is a market failure because the product is designed to please participants and insiders rather than auto racing consumers in the United States. The latter group has demonstrated that it will tune in consistently to watch a product that is designed for its benefit.

It's not 1995 Anymore

Television ratings are less important when market inefficiencies can be exploited and supply chains can be arbitraged. However, unlike CART, the IRL will not succeed in these pursuits because tobacco advertising inefficiencies have been corrected and nearly all U.S. industrial supply chains lead to NASCAR (sans-culottes!). That is why IndyCar is now attempting to arbitrage the Brazilian supply chain.

As we have written before, we like television ratings because they provide a reliable measurement of market acceptance. They can not be bought. They are not influenced by comp tickets and compulsory attendance at corporate outings. They can not be camouflaged by signage and majestic terrain. They are not perverted by four-day attendance figures. They tell the truth even when the truth hurts badly.

The IRL must manage its product. Doing so will require that it take actions that will not be liked by some of its suppliers of racing teams. Costs must be slashed. Many drivers must be replaced.

Unless and until customers are served to their satisfaction, the IndyCar Series will remain a market failure. To think that ABC and ESPN would accept a time buy is ridiculous. ESPN could not wait to get rid of this product. That is why it allowed the IRL to leave a year early.

The marketplace is competitive. ESPN has many, many more options than it did back when CART bought air time. IndyCar racing in its present form does not deserve a major U.S. television partner.

Versus is stuck with IndyCar.

Roggespierre